Home Mortgages Confusing You? Attempt These Tips Out

Content written by-Fink StormMany people go out in search of new home without realizing that it can be difficult to get approved for a home mortgage. If you are in the dark about this subject, you will need good tips to help get you caught up. Read on for great home mortgage tips that anyone can use.

To make your application for a mortgage fast and easy, make electronic copies of your last two pay checks, two recent bank statements, W2s, and tax information. Lenders will ask for all of this information to go with the application and having them on hand in electronic format makes it easy to supply this information.

You should have a work history that shows how long you've been working if you wish to get a home mortgage. Most lenders require a solid two year work history in order to be approved. An unstable work history makes you look less responsible. Also, never quit a job while applying for a loan.

Reducing your debt as much as possible will increase your chances of being approved for a mortgage. If Click Link are not in a good financial situation, meet with a debt consolidation professional to get out of debt as quickly as possible. You do not need to have a zero balance on your credit cards to get a mortgage but being deeply in debt is definitely a red flag.

If you are underwater on your home and have been unable to refinance, keep trying. Recently, HARP has been changed to allow more homeowners to refinance. Lenders are more open to refinancing now so try again. If the lender will not work with you, look for someone who will.

If your appraisal isn't enough, try again. If the one your lender receives is not enough to back your mortgage loan, and you think they're mistaken, you can try another lender. You cannot order another appraisal or pick the appraiser the lender uses, however, you may dispute the first one or go to a different lender. While the appraisal value of the home shouldn't vary drastically too much between different appraisers, it can. If you think the first appraiser is incorrect, try another lender with, hopefully, a better appraiser.

You may want to hire a consultant to help you with the mortgage process. There are lots of things involved with the process and a consultant will be able to get you a great deal. You'll also be sure that the all is on the up and up when you've got the knowledge of a consultant at your fingertips.

If you have bad credit, avoid applying for a home mortgage. Although you may feel financially ready enough to handle the costs of a mortgage, you will not qualify for a good interest rate. This means you will end up paying a lot more over the life of your loan.

Make sure you pay down any debts and avoid new ones while in the process of getting approved for a mortgage loan. Before a lender approves you for a mortgage, they evaluate your debt to income ratio. If your debt ratio is too high, the lender can offer you a lower mortgage or deny you a loan.

Avoid paying Lender's Mortgage Insurance (LMI), by giving 20 percent or more down payment when financing a mortgage. If you borrow more than 80 percent of your home's value, the lender will require you to obtain LMI. LMI protects the lender for any default payment on the loan. It is usually a percentage of your loan's value and can be quite expensive.

If you have bad credit, avoid applying for a home mortgage. Although you may feel financially ready enough to handle the costs of a mortgage, you will not qualify for a good interest rate. This means you will end up paying a lot more over the life of your loan.

Understand what happens if you stop paying your home mortgage. It's important to get what the ramifications are so that you really know the seriousness of such a big loan as a home mortgage. Not paying can lead to a lower credit score and potentially losing your home! It's a big deal.

Remember that https://www.nola.com/news/business/article_f63a56fa-a157-11ec-ab17-4b19de44d222.html takes time to get a mortgage closed; therefore, it is important to include enough time in the sales contract for the loan to close. Although it may be tempting to say the deal will be closed within 30 days, it is best to use a 60 or 90 day timeframe.

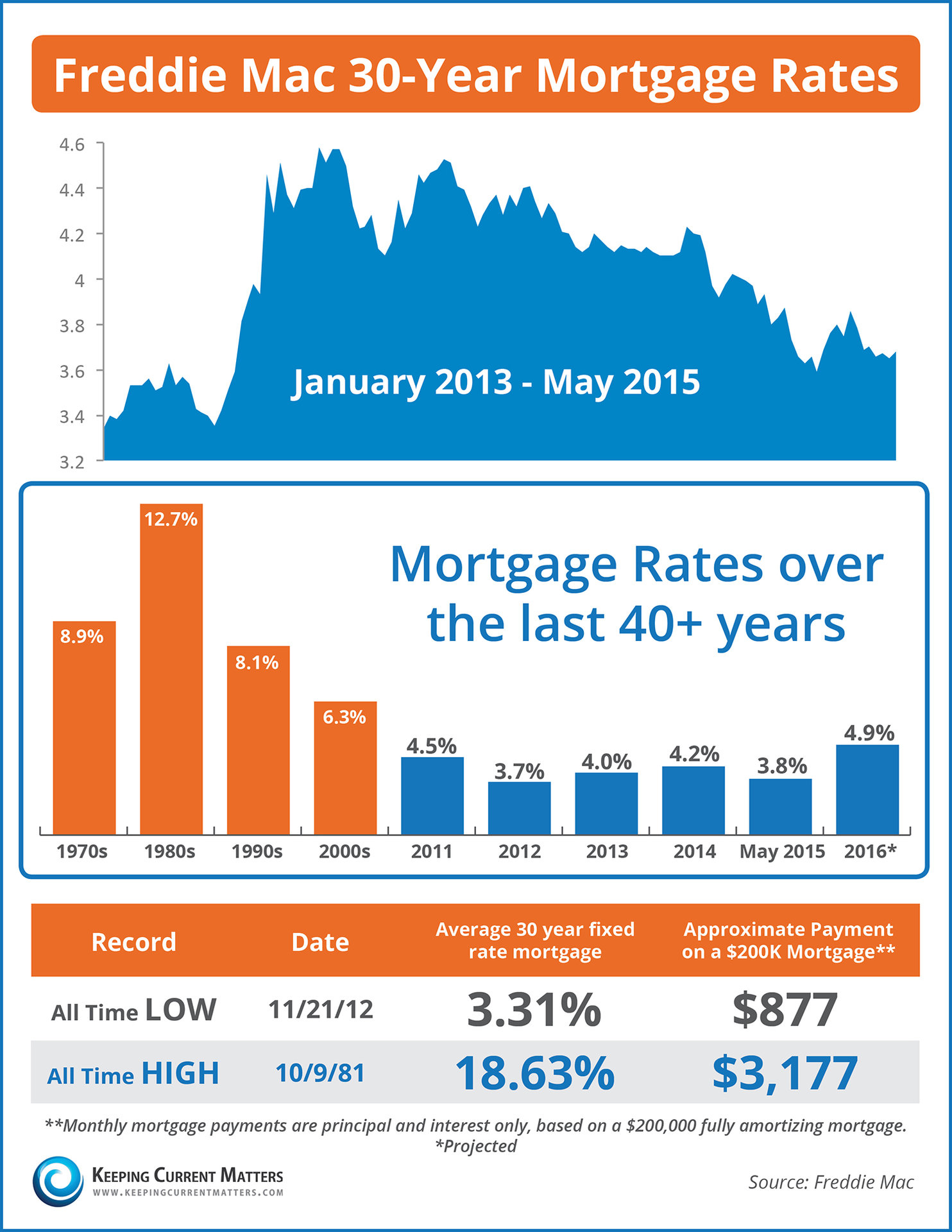

When rates are near the the bottom, you should consider buying a home. If you do not think that you will qualify for a mortgage, you should at least try. Having your own home is one of the best investments that you can make. Quit throwing away money into rent and try to get a mortgage and own your own home.

Put as much as you can toward a down payment. Twenty percent is a typical down payment, but put down more if possible. Why? The more you can pay now, the less you'll owe your lender and the lower your interest rate on the remaining debt will be. It can save you thousands of dollars.

When trying to figure out how much of a mortgage payment you can afford every month, do not neglect to factor in all the other costs of owning a home. There will be homeowner's insurance to consider, as well as neighborhood association fees. If you have previously rented, you might also be new to covering landscaping and yard care, as well as maintenance costs.

When a seller receives a letter of a loan approval, then this will show them you are definitely ready to buy. It shows that your financial background has been checked out and you are ready to go. Don't even look at homes that go over the preapproval number. If it shows a higher amount, then the seller will see this and realize you could pay more.

If your downpayment is less than 20% of the sales price of the home you want to buy, expect the mortgage lender to require mortgage insurance. This insurance protects the lender in the event that you can't pay your mortgage payments. Avoid mortgage insurance premiums by making a downpayment of at least 20%.

Be sure you are honest when you're applying for a loan. If you aren't truthful, you may be denied the loan you seek. Lenders will not have faith in you if you tell lies.

As was stated in the introductory paragraph of this article, the mortgage financing process is very complicated. It can seem indecipherable to a real estate novice. The key to financing a great mortgage that allows you to buy the home of your dreams is to educate yourself on the mortgage process. Study the mortgage tips and advice in this article very carefully.